Key Takeaways

- Freight Factoring is when a trucking company sells their outstanding invoices (accounts receivable) at a discount to a factoring company in exchange for same day cash.

- Freight Factoring primarily benefits trucking companies who work with brokers or shippers with extended payment terms, such as 30, 60, or 90 days.

- Freight Factoring can give trucking companies the liquidity and flexibility necessary to scale their businesses.

What Is Freight Factoring?

Freight factoring is a financial tool where a trucking company sells unpaid invoices to a factoring company in exchange for immediate cash. Instead of waiting 30, 60, or even 90 days, carriers can get paid same day, ensuring that they can cover fuel, maintenance, and payroll expenses.

Freight factoring is a subset of accounts receivable factoring (also known as invoice factoring, or just factoring). Factoring is not new. Some historians trace its roots to ancient Mesopotamia, yet the popularity of modern freight factoring is a fairly recent development. This surge in popularity can be attributed to changes in UCC laws and the deregulation of the trucking industry in the mid-20th century.

Why Use Freight Factoring?

Freight factoring puts cash into your bank account faster, enabling you to cover expenses and continue growing your business. Many freight brokers and shippers will not pay their carriers for 30, 60, or even 90 days. This creates a cash flow gap between income and expenses that can make it difficult for a trucking company to continue operating. You could deliver a load and wait 30 days to get paid, but if you need to pick up another load, you also need to pay for fuel. The problem compounds itself over the course of the month as you haul more and more, so that by the time you receive payment for the first delivery, you’ve already had to pay fuel expenses for 15-20 other deliveries. That could easily be $3,000 to $4,000 in just fuel expenses before seeing a dime of profit.

Freight factoring closes the cash flow gap so that you can get paid the day you deliver, assuming all your documentation is correct and there are no issues with the shipper or broker. This allows you to be more flexible, take on more jobs, and continue growing your business.

Who can benefit from Freight Factoring?

Freight factoring isn’t just for large fleets. It’s for anyone in the trucking industry with outstanding invoices who needs reliable cash flow to keep their business moving. Common users include:

- Owner-Operators: Running one or two trucks? Factoring helps you get paid faster so you can focus on hauling loads, not chasing payments.

- Small Fleets: Factoring ensures you have the cash to grow your business, add more drivers, or take on larger contracts.

- Mid-Sized and Large Fleets: Factoring provides predictable cash flow to cover payroll, maintenance, and operational expenses.

- Freight Brokers: Brokers use factoring to manage payments to carriers while waiting for shippers to pay.

Is Freight Factoring a Loan?

Freight factoring is not a loan or line of credit. Instead of borrowing money, you are selling a financial asset—your unpaid invoices or accounts receivable. This means that ownership transfers from you (the carrier) to the factor.

Since freight factoring is not a loan, there are several perks and advantages:

- Quick Funding: Underwriting, approval, and funding can often happen in days, not weeks.

- No Debt: Since factoring is not a loan, it does not add debt to your business balance sheet and the responsibility of repayment rests on your customers (your brokers or shippers).

- Customer Credit Focus: Approval is based on the creditworthiness of your customers (your brokers or shippers), not your business’s credit score.

How Freight Factoring Works

Freight factoring works by advancing 80-95% of your invoice value upfront, letting you get paid fast while the factoring company collects payment from the shipper or broker.

Understanding Freight Factoring

Factoring can be a little confusing, so before going any further, below are some of the most important terms that we will use throughout the remainder of this article.

Advance Rate

This is the percentage of the invoice value that the factor advances to you (the carrier). For freight factoring, this percentage can be anywhere between 80-95% of the invoice value.

Reserve

The reserve is a portion of the invoice value that the factor holds back temporarily to safeguard against potential risks. These risks include non-payments, invoice disputes, or other unforeseen issues.

The way a reserve account operates depends on your factoring agreement. Some freight factoring companies will take a small percentage from each invoice until the total reserve balance equals 5-10% of your outstanding invoices. The factor may release additional reserves to you (the carrier). Other factoring companies will only release the reserve at the termination of the contract. Still others will take a larger percentage upfront (often 5-20%), but will release the reserve once the invoice pays.

The money held in reserve technically belongs to you (the carrier), but per the factoring agreement, it is controlled by the factor to mitigate their risk until the factoring agreement determines that the money may be released to you. Whether or when you can access those funds depends on the agreement and the internal policies of the factoring company.

Discount Rate/Factoring Fee

The discount rate (or factoring fee) is a percentage of the invoice value that the factoring company receives for providing their services. Often, a discount rate falls between 1-6% of the invoice value. The fee can be a flat rate that is charged when the factor purchases the invoice, or, in more complex agreements, you may have a tiered or daily rate that accrues until the invoice is paid. There are other, more complex rate structures that some factors may offer, but the standard in freight factoring is a flat fee charged at the time of purchase.

Account Debtor

The account debtor is your customer, the business that is invoiced. For trucking companies, the account debtor is the shipper or the freight broker. It is important to ensure that you are working with a reputable account debtor to avoid the risk of nonpayment. Some freight factors will offer credit checking services to help ensure that you are hauling for trustworthy account debtors.

Verification

Invoice verification is when the factor verifies with your customer (the account debtor) that the load has been delivered and that the documentation is correct. Verification may be done by phone, email, or by online portal, if available.

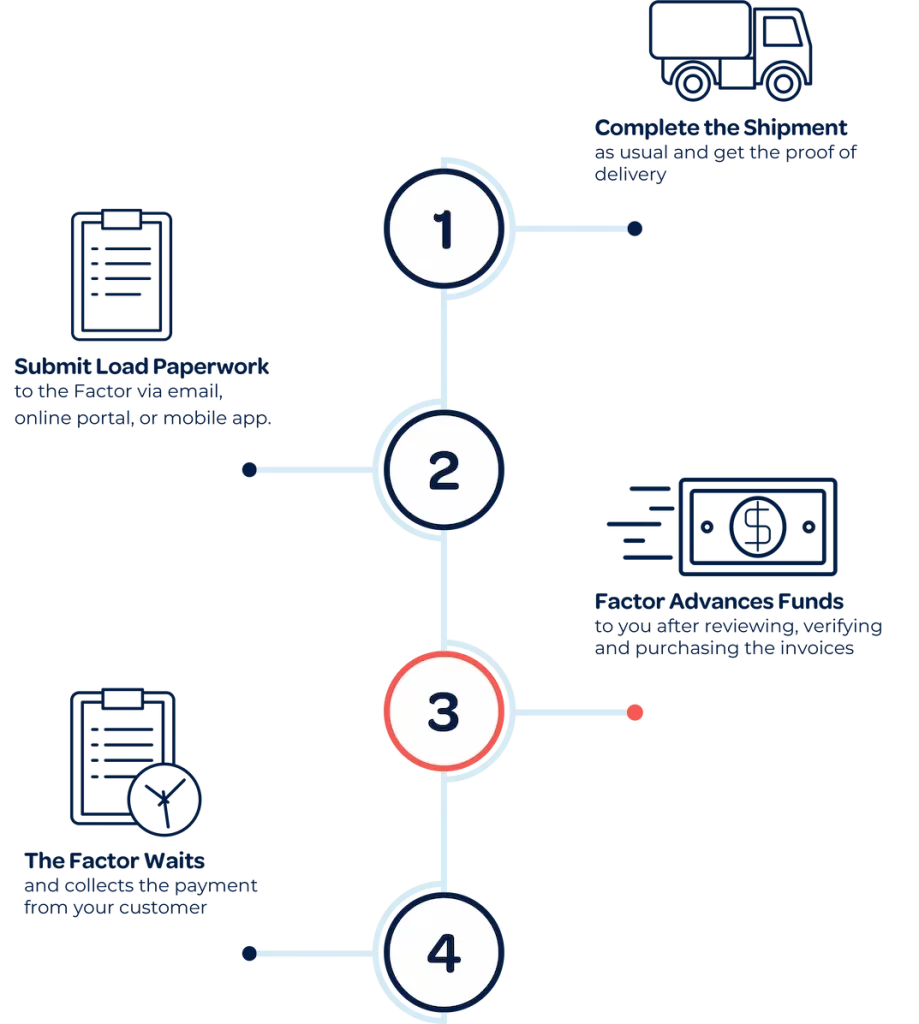

Step-by-Step Process

1. Complete the Shipment

Deliver the load as usual and get the proof of delivery (POD) or a signed Bill of Lading (BOL). You need some form of these documents to show the factoring company that the job is complete.

2. Submit Paperwork to the Factor

Many factoring companies will accept your load paperwork (POD, BOL, rate confirmation) through email or an online portal, and will invoice your account debtors for you. A factoring company may also accept your own internal invoices, but it often depends on your relationship with the factor.

3. The Factor Advances Funds

The factoring company reviews your invoice and/or load documentation, verifies that the information is correct with the account debtors, and advances you a percentage—usually 80-95% of the invoice amount. Some factors advance within 24 to 48 hours, while others offer same day funding (assuming all documentation is correct).

4. The Factor Waits for Payment

The factoring company then waits for the account debtor to pay the invoice. The factoring company will handle most or all of the collections process, depending on whether the agreement is for recourse or non-recourse factoring.

Example Scenario

Let’s say you deliver a load worth $10,000, and your factoring company offers a 1% reserve with a 3% discount rate (factoring fee):

- You complete the delivery and submit your paperwork

- The factoring company reviews and verifies your paperwork

- The factoring company advances you $9,600. $100 (1%) is held in reserve while $300 (3%) is taken as the factor’s service fee

- The account debtor pays the factoring company the full $10,000 after 30 days

In this example, you get $9,600 in total—quick cash flow minus a small cost.

Types of Freight Factoring

The main types of freight factoring are recourse (lower fees but the carrier assumes risk), and non-recourse (higher fees but the factor assumes risk).

Recourse Factoring

Recourse factoring is the most common form of factoring because it comes with lower fees. With recourse factoring, your business is responsible if an account debtor doesn’t pay the invoice. The factoring company reserves the right to return any unpaid invoices to you after a specified period (generally 45 to 90 days, depending on the agreement).

Think of it like a return policy at a retail store. If a retailer sells a defective product, the consumer has the right to return the product and receive a refund. The same is true in a recourse factoring agreement. If you (the carrier) sell a defective product (invoices that won’t be paid), then the factor reserves the right to return those invoices for a refund.

Non-Recourse Factoring

Non-recourse factoring shifts the risk of non-payment to the factoring company. If the shipper or broker goes bankrupt or becomes insolvent, you, as the carrier, are protected. The factoring company generally cannot return those invoices to you in that scenario. Since the factoring company assumes the risk, non-recourse factoring is often more expensive than recourse factoring.

It is important to note, however, that most non-recourse factoring typically only covers account debtor insolvency, not disputed invoices. This can make non-recourse factoring less valuable to you because most non-payments are caused by invoice disputes rather than the account debtor going out of business.

Comparing Recourse and Non-Recourse Factoring

| Recourse | Non-Recourse | |

| Benefits | Lower cost Faster approvals Higher advance rates. | More protection Reduced Risk |

| Drawbacks | Less protection More risk of chargebacks | Higher cost Lower advance rates Usually only covers insolvency |

| Best for | Trucking companies working with reliable shippers or brokers. | Businesses working with high-risk shippers or in volatile markets. |

For a more comprehensive overview, check out our article on Recourse vs Non-Recourse Factoring

Costs of Freight Factoring

Freight factoring costs include the discount rate (or factoring fee) and other potential charges such as setup fees or ACH/wire fees. Transparent pricing is key when selecting a factoring company.

Discount Rate (Factoring Fees)

Freight factoring discount rates typically fall between 1-6% of the invoice value. The following factors may influence this fee:

- Average Invoice Value: Larger invoices can result in lower factoring fees. A $500 invoice and a $5,000 invoice require the same amount of work from the factor, and receiving 3% of $5,000 is more worth the factor’s time than receiving 3% of $500. Therefore, hauling larger loads as an 18-wheeler will probably get you better pricing than hauling smaller loads as a box truck.

- Invoice volume: Higher volume often means lower fees. So, if you are a fleet owner with 20 trucks, likely you will be able to negotiate better rates.

- Customer creditworthiness: If you are hauling for less credible account debtors, that may negatively impact pricing.

- Payment terms: Often Net 30 invoices cost less to factor than Net 90.

Additional Costs

Other common fees charged by factoring companies include:

- Setup fees: A setup fee is a onetime fee charged at the beginning of the factoring relationship to cover administrative costs associated with setting up and underwriting the account.

- Monthly minimums: Some factoring companies have volume requirements for their carriers. For example, a factoring agreement may stipulate that a carrier must sell $10,000 worth of invoices per month, or else they will be charged a monthly fee for keeping the account open.

- Variable Rates: Some factoring companies won’t charge a set monthly minimum fee, but may have conditions in the contract which allow them to increase the discount rate if certain requirements aren’t met. These conditions may include monthly minimums, or may even require the carrier to use a certain fuel card.

- Early termination penalties: If a factoring company has year-long or multi-year contracts, there will likely be a penalty if the carrier terminates the contract prematurely.

- Wire transfer, ACH or RTP fees: These are fees associated with electronic transfers.

- Per invoice fees: A factor may charge a small fee per invoice submitted, since a flat rate may not cover all their costs. This is especially applicable with lower value invoices.

Calculating the True Cost

Let’s revisit the $10,000 example with the 1% reserve and 3% discount rate:

- Invoice value: $10,000

- Reserve (1%): $100

- Fee (3%): $300

- Total Received: $9,600

However, assuming that the factor has additional fees:

- ACH Fee: $5

- Per Invoice fee: $1.50

- Total received: $9,593.50

So, while the factoring fee is 3%, the additional fees amount to 0.07%, plus the 1% reserve. This means that you would be receiving a little under 96% of the invoice value.

Benefits of Freight Factoring

We already mentioned that freight factoring improves cash flow by closing the time gap between income and expenses. However, there are other benefits as well, such as outsourcing invoicing and collections, saving you time so that you can focus on growing your business.

Improved Cash Flow

- Get paid within days instead of waiting 30-90 days.

- Cover expenses like fuel, maintenance, and payroll without stress.

Outsourced Collections

- Let the factoring company handle collections calls and payment follow-ups.

- Focus on driving and growing your business instead of chasing invoices.

Business Growth

- Factoring helps you accept more loads by ensuring you have the cash to operate.

- Avoid missing out on opportunities due to limited cash flow.

Additional Services

- Many factoring companies offer fuel cards with discounts at major truck stops.

- Some factoring companies offer fuel advances which give you cash upfront to fill your tanks before hitting the road.

Potential Risks of Freight Factoring

While freight factoring offers many advantages, it’s important to understand the potential risks and downsides before committing. A well-informed decision ensures factoring aligns with your business goals.

Dependency on Factoring

- The Risk: Over-reliance on factoring can lead to reduced profitability. Factoring fees generally take 1-6% from top line revenue, so excessive use may strain your finances.

- How to Mitigate: Use freight factoring strategically. Factoring may not be an everyday need. Some businesses may build an internal cash reserve to cover cash flow gaps. Others may find factoring to be the best option because of high growth.

Costs and Hidden Fees

- The Risk: Some factoring companies charge additional fees, such as setup fees, or monthly minimums, which can inflate costs. Others may require you to use their fuel card in order to avoid rate increases.

- How to Mitigate: Choose a factoring company with transparent pricing. Always request a full breakdown of fees upfront and review the contract closely so you are not surprised and can plan accordingly.

Impact on Customer Relationships

- The Risk: Since factoring companies interact directly with your customers, unprofessional handling of collections can damage customer relationships.

- How to Mitigate: Research the factoring company’s reputation for professionalism. Choose a partner with experience, that cares about your relationship with your customers, and acts as a partner, not a debt collector.

Non-Recourse Limitations

- The Risk: Non-recourse factoring doesn’t cover all risks. For instance, it usually only protects against customer insolvency, not disputes or delays.

- How to Mitigate: Understand the scope of non-recourse agreements. Ensure you’re comfortable with the remaining risks.

Freight factoring is a powerful financial tool when used wisely, but it’s not without risks. By understanding and preparing for potential downsides, you can make factoring work in your favor without surprises.

Common Freight Factoring Myths

Freight factoring is often misunderstood, leading to myths that may prevent trucking companies from considering this valuable financial tool. Let’s debunk the most common misconceptions.

Myth 1: Freight Factoring Is Too Expensive

As we’ve mentioned, freight factoring fees range from 1-6% of the invoice value. For some carriers, this may be too much, but each carrier should assess their situation and analyze the costs vs the benefits. The value of immediate cash flow should not be understated.

Myth 2: Freight Factoring Damages Customer Relationships

While some factoring companies act more like debt collectors, reputable factoring companies handle collections professionally, ensuring your account debtors are treated with respect.. Research the factoring company’s reputation, and ask how they interact with account debtors during the collections process.

Myth 3: Freight Factoring Indicates Financial Trouble

While factoring can help companies in financial distress, it can also be a strategic tool for businesses with growth potential. Factoring optimizes cash flow, which helps businesses seize opportunities and scale operations.

How to Choose the Right Freight Factoring Company

Selecting a good factoring partner is crucial. The right factor can provide reliable cash flow and exceptional service, becoming an indispensable financial partner. The wrong factor can lead to hidden costs and headaches.

What to look for in a Freight Factoring Company

When choosing a freight factoring company, consider their reputation, fees, industry expertise, and customer service. Be sure to understand rate structures, contract terms, reserves and advance rates.

Reputation and Accountability

Look for factoring companies with proven experience in the trucking industry that understand the unique challenges of the freight industry. Check reviews, testimonials, and memberships in organizations like the International Factoring Association (IFA).

Whether a factoring company is bank owned can also be a good indicator of reputation and accountability. The factoring industry is not highly regulated, but bank owned factoring companies are held to the same standards and regulations as the banking industry, meaning that they are often subject to internal, external, federal, and state level audits.

Customer Service

Not only does customer service matter to ensure that you have a positive experience with your factoring company, but your factoring company will also interact with your customers, so choosing one with a reputation for professionalism and responsiveness is crucial.

Transparency in Fees and Terms

Ensure the factor discloses all costs upfront, including factoring fees, ACH fees, and any additional charges. Be aware of long-term contracts with high cancellation fees unless you’re sure of the relationship. Ask for a sample cost breakdown to understand what you’re paying for.

Look for competitive advance rates (typically 90-95%) and understand if or when reserves are released and how they’re managed.

Technology and Trucking Specific Perks

Trucking is a highly mobile industry. It’s important to ensure that a factoring company is able to accommodate your needs from a technology perspective. This could be through online portals to monitor your account or mobile apps.

Trucking-specific features like fuel advances and fuel cards are also huge perks.

Questions to Ask a Factoring Company

- What are your fees and are there any additional charges?

- What advance rates do you offer?

- How quickly will I receive funding after submitting an invoice?

- Do you offer recourse or non-recourse options? Which is better for my business?

- Can you provide references or testimonials from other trucking companies?

Red Flags to Watch For

- Hidden Fees: Factors that don’t disclose all charges upfront may surprise you with setup fees, monthly minimum fees, or termination penalties.

- Rigid Contracts: Avoid long-term agreements that lock you in without flexibility.

- Poor Customer Service: The factoring company will be working with your customers. An unresponsive or unprofessional factoring company can hurt your customer relationships.

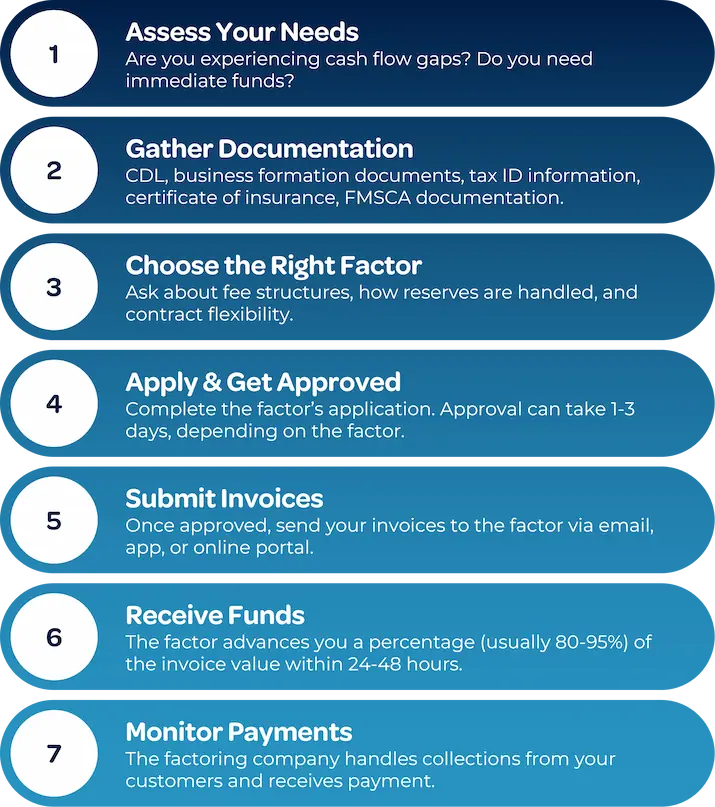

How to Get Started with Freight Factoring

Getting started with freight factoring is easier than you might think. Here’s a step-by-step guide to help you begin:

Step 1: Assess Your Needs

To get started with freight factoring, assess your cash flow needs and decide whether factoring is right for your business.

- Are you experiencing cash flow gaps that you can’t cover?

- Do you need immediate funds for fuel, payroll, or repairs?

- Are you unable to secure traditional financing?

- Are you passing up on opportunities while waiting on customer payments?

Step 2: Gather Required Documentation

To set up, most factoring companies require at least:

- Commercial driver’s license

- Business formation documents

- Tax identification documentation

- FMCSA documentation

- Certificate of Insurance

Some factors may ask for more or less, depending on their approval requirements. Having this information ready and on hand will speed up the approval process.

Step 3: Choose the Right Factoring Company

Use the criteria from the previous section to evaluate potential factoring partners. Ask about:

- Fees and advance rates.

- Contract flexibility (recourse vs. non-recourse).

- Industry expertise, especially in trucking.

Also check online reviews and whether the factoring company is an IFA member.

Step 4: Apply and Get Approved

- Complete the factoring company’s application process.

- Approval often takes 1-3 days, depending on the factor, their underwriting procedures, and how quickly you send them your documentation. Larger deals will probably take longer.

Step 5: Submit Invoices

Once approved, send your invoices to the factoring company. This can typically be done via email or through an online portal.

Step 6: Receive Funds

After verifying your invoices, the factoring company advances you a percentage (usually 80-95%) of the invoice value within 24-48 hours. Some factoring companies may be able to fund the same day.

Step 7: Monitor Payments

The factoring company handles collections from your customers and receives payment.

Tips for Success:

- Start with a trial run by factoring a small number of invoices.

- Maintain clear communication with your factoring company to avoid misunderstandings.

- Regularly review your cash flow strategy to ensure factoring remains beneficial for your business.

Conclusion: Freight Factoring as a Strategic Tool

Freight factoring is more than just a way to get paid faster—it’s a strategic financial tool that can empower carriers to thrive in a competitive industry. By converting unpaid invoices into immediate cash, freight factoring provides the liquidity needed to cover fuel, maintenance, payroll, and other essential expenses without waiting for customer payments.

Review: Key Benefits of Freight Factoring

Freight factoring is a flexible, debt-free financing solution that improves cash flow, helps trucking businesses grow, and reduces the stress of waiting for customer payments

- Improved Cash Flow: Factoring ensures you have the funds to keep your trucks on the road and accept more loads.

- Flexibility: Whether you’re an owner-operator or managing a growing fleet, factoring scales with your business.

- No Debt: Unlike loans, factoring doesn’t add to your liabilities or require monthly repayments.

- Professional Support: Factoring companies often handle collections, saving you time and resources.

Is Freight Factoring Right for You?

Factoring is an excellent solution for trucking businesses that:

- Struggle with delayed payments from shippers or brokers.

- Need consistent cash flow to cover operational costs.

- Want to grow without relying on traditional loans or lines of credit.

However, it’s not a one-size-fits-all solution. By understanding the costs, benefits, and potential risks, you can decide if factoring aligns with your financial goals and operational needs.

If you think it might be a good fit for your business, reach out to Flexent Freight Funding!